Ask yourself – if I lost my top 5 biggest clients overnight – how many months could the business survive?

Or even if your revenue dropped to zero. When is it lights out, game over?

In this article we look at working out your cash runway, and why it’s crucial for you to keep some backup funds in your business.

First, let’s define cash runway.

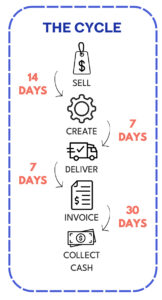

How much money is in your bank = Cash position

How much you are using each week = Cash burn rate

How long it will last = Cash runway

Why is cash runway important?

Having spare cash on hand helps buy your time in case of a change in business conditions. It gives you enough time to reflect, then react and not make bad decisions as you are under immediate financial pressure.

If you are worried about survival you might start lowering your prices and taking on poor-quality clients which creates a negative cycle with ongoing problems for the business.

You might have to fire staff, even if they are valued team members. This is terrible for your internal culture and creates more work down the line, needing to hire and train up replacements once conditions improve.

Cash runway helps you make confident decisions that are best for the long term of the business – not just reacting to every small change in the market.

It reduces your stress, knowing you have back up funds and could even help you sleep better at night.

How do I increase my runway?

It can have many names: capital reserves, vault, warchest, rainy day fund, savings account etc.

The larger the balance in this account, the longer your runway becomes.

We recommend building up a separate bank account of savings: enough cash to cover your operating expenses + staff wages for around 2-3 months.

How to work out your target:

- Based on Expenses:

Target Cash Runway = (Monthly Staff Wage Bill + Monthly Operating Expenses) x 3 months

If you want to smooth out your target, just take the monthly average for the past quarter of both the Wages + OPEX.

Are your monthly expenses fluctuating wildly and hard to work out what 3 months’ worth will be?

- Based on Revenue:

Another easy way to work out how much cash you should have on hand is to take your YTD top-line revenue and start to build up a minimum of 10% of Revenue.

E.g Annual Revenue of $500,000 then build a vault of $50k, then gradually increase your 10% up to 30% if possible which is $150k .

Use this runway metric when reviewing your sales pipeline to help you with planning.

How to build this up:

Each quarter, take a certain % of your profits for that period (we recommend 50% or higher) and transfer it across to your Savings account.

These funds are NOT to be touched for any operational needs – and are purely for in case of defined special situations (such as a downturn).

A more in-depth way to monitor your cash runway is a cash flow forecast. We truly believe EVERY business should be doing one at least monthly.

Get in touch with us if you would like help building one.